There has been much talk about financial derivatives in the investing community lately. However, these instruments can be as understandable as Inscriptions for most people who have entered the stock market.

Do you sometimes need clarification when someone talks of options or futures? The world of derivatives is vast and can be complex for an ordinary investor.

Investing in something without really knowing what it is is dangerous. Don't worry—this blog post will explain financial derivatives.

Read on, and you will eventually understand derivatives and how they function. Are you ready to learn more about derivatives?

Let's get started!

What Are Financial Derivatives?

Have you ever played with building blocks? Financial derivatives are similar, but they are related to money. They are securities that derive their worth from another commodity, often securities, bonds, or commodities.

Derivatives can be considered contracts related to these essential assets and are side bets on their performance. They are not securities of ownership; they are contracts concerning the future value or behaviour of the investment.

Futures are contracts that provide for the purchase or sale of a commodity at a given price on a provided date. Calls allow you to buy or sell, but you don't have to. Swaps are contracts under which one cash flow is exchanged for another.

Derivatives are employed for risk management, to bet on price fluctuations, or to gain exposure to difficult-to-trade instruments. They are excellent tools, but they should be used properly.

Types of Financial Derivatives

Now, it is necessary to discuss types of financial derivatives in detail. Here are some types of financial derivatives:

1. Futures: The Grocery List of Finance

Suppose you are preparing for a grand dinner next month. You are correct that you will get many ingredients, but the price may increase. Futures contracts are like a pre-order for those ingredients at today's prices.

In the financial context, futures allow you to make a contract to either purchase or sell an item at a predetermined price on a given date in the future. It is a legal agreement; both parties must act when the time comes.

2. Options: The "Maybe" of the Market

Options include having a coupon, which can sometimes be helpful. You initially give a small amount of money for an option to purchase or sell at a particular price in the future but are not bound to do so.

There are two primary flavours:

A call is the buyer's request that the seller bring forward stocks, while a put is the seller's instruction that the buyer take away stocks.

Calls provide an opportunity to buy while offering a chance to sell. It comes down to elasticity and risk management.

3. Swaps: The Great Exchange

Have you ever swapped lunches as a learner? Swaps work similarly, but instead of mere replacing, they involve financial stuff. 2 parties enter into a contract to trade one stream of cash flows for another.

It could involve switching from payments at fixed interest rates to variable interest rates or exchanging payments in one currency for another. Swaps are used for hedging and may provide better terms than conventional markets.

Pros and Cons of Using Financial Derivatives

Derivatives have their advantages and disadvantages. Let's break it down:

1. The Good Stuff

Derivatives can be used to secure. They work like a shield, preventing your investment from fluctuating with the market similarly. This is perfect for ensuring your positions and minimizing your risks.

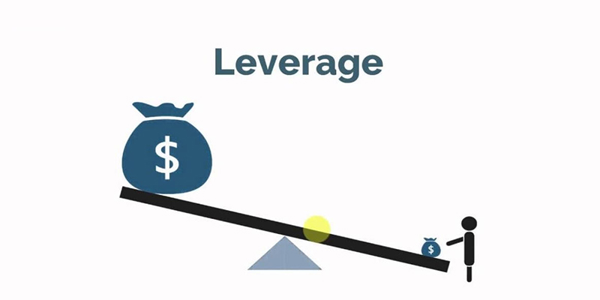

When it comes to derivatives, a little can go a long way. They allow you to trade with a more significant asset with less capital through leverage.

To the knowledgeable investor, derivatives make it possible to increase profits and access new opportunities in the market.

2. The Not-So-Good Stuff

What does leverage mean, and what is its opposite? Small market risk can be devastating if not managed correctly in the football trading business.

Derivatives can often be intricate; some are close to being or already off the wall. One can find themselves overcome by the minutiae and make expensive errors.

The market can be volatile, and volatility gets magnified in derivatives. If things worsen, you could lose more than the amount you invested.

Derivatives are excellent instruments, but they must be used with caution. They are only for some, but they are helpful when applied correctly.

Understand Financial Derivatives Completely!

Having introduced you to derivatives, why not take it to an excellent higher level and learn more about the subject? Continuously expand your financial literacy and educate yourself.

You can add to what you have learned today by reading books, taking online courses, or attending workshops. Before making any big moves, talking to a financial planner is wise.

Comprehension of derivatives is about more than just financial shuffle and dance. It is the rationalization of money decisions. Continue searching, remain interested, and see your financial literacy level rise!

Frequently Asked Questions

Q. What is a financial derivative?

Ans: An agreement derives its worth from an underlying asset, such as stocks or any other marketable item. You can think of it as speculation on the performance of that particular asset without having to own it.

Q. How do futures contracts work?

Ans: Futures are contracts to purchase or sell a particular asset at a specific price later. It is like an agreement that you will buy a car next year at the current rates of the vehicles, whether the rates will go down or rise in the future.

Q. What are the risks associated with derivatives?

Ans: The significant risks are putting more than you can afford to lose, being on the wrong side of the market, and losing due to the complexity of the options. It is as if you are playing with a knife, but risky if you are not careful.

Q. Can beginners invest in derivatives?

Ans: Yes, but it is the same as starting to swim in water up to the neck. It is challenging and can be very risky, especially for new investors. It is recommended that investors invest in other forms of securities before embracing derivative securities.