Merchandise retail can be both exciting and intimidating for investors, whether they are novice or seasoned traders. A thorough understanding of merchandise retail and its complexities is required to navigate this financial terrain. Publications have traditionally been a significant resource for investors looking to further their wisdom and abilities. This article will discuss the top ten merchandise retail publications that provide research and realistic insights into investing. These publications are instructive and compelling since they can change how readers think about investing, motivating them to make better decisions and achieve financial success.

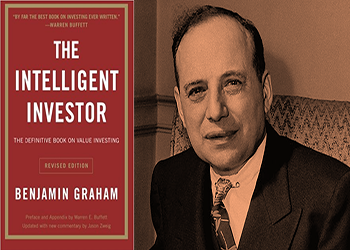

1.Benjamin Graham's "The Quick-witted Investor"

Often referred to as the "Bible of Value Investing," Benjamin Graham's "The Quick-witted Investor" is a timeless classic. Graham, a great investor, and Warren Buffett's mentor emphasizes the significance of investing with logic and discipline. The publication exposes readers to the "margin of safety" and offers valuable insights into merchandise analysis and retail swings. It promotes investing with a long-term view and concentrating on basic research rather than short-term retail speculation.

2.Burton G. Malkiel's "An Aimless Walk Down Wall Lane"

In "An Aimless Walk Down Wall Lane," Burton Malkiel questions the premise of continuously outperforming retail and advocates for efficient retail theory. The publication goes into the idea that merchandise prices change randomly, making short-term price swings impossible to forecast. He believes diversity and low-cost index investing are the best ways to achieve long-term success in merchandise retail. His strong ideas and engaging writing style make this publication a must-read for those seeking a deeper grasp of retail efficiency and investing methods.

3.William J. O'Neil's "How to Make Money in Merchandises"

The creator of Investor's Business Daily, William J. O'Neil, outlines a comprehensive system for merchandise trading and investing in "How to Make Money in Merchandises." The publication exposes readers to the unique approach, emphasizing technical research, identifying retail leaders, and comprehending retail cycles. His method is supported by considerable research and offers practical advice on merchandise selection, entry and exit locations, and risk management. This publication appeals to people interested in growth investing and trading using technical indicators.

4.Jack D. Schwager's "Retail Wizards"

In "Retail Wizards," Jack Schwager combines conversations with some of our generation's most accomplished traders. The publication provides readers with significant insights into these traders' thoughts, techniques, and psychological elements of trading. He emphasizes the significance of discipline, adaptation, and risk management in attaining constant retail profitability. "Retail Wizards" persuades readers to investigate several methods and select one that matches their personality and risk tolerance by exhibiting the unique ways of these great traders.

5.Peter Lynch's "One Up on Wall Lane"

The former manager of Fidelity's Magellan Fund, Peter Lynch, reveals his investment philosophy in "One Up on Wall Lane." He argues that by spotting potential firms daily, individual investors have a considerable edge over institutional investors. He emphasizes the significance of completing extensive studies and focusing on long-term patterns rather than short-term price fluctuations. His straightforward writing style and real-world examples convince readers to take a more patient and opportunistic approach to investing.

6.Philip A. Fisher's "Common Merchandises and Uncommon Profits"

Philip A. Fisher, a growth investing pioneer, reveals his concepts and strategies in "Common Merchandises and Uncommon Profits." Before investing, he emphasizes knowing a company's management, development potential, and competitive advantages. The publication also delves into the significance of performing on-the-ground research and keeping a long-term investment view. His compelling arguments and emphasis on qualitative research make this publication an invaluable resource for investors looking for firms with high growth potential.

7.John C. Bogle's "The Little Publication of Common-Sense Investing"

John C. Bogle, the inventor of Vanguard and a proponent of index investing, makes a compelling argument for low-cost, passive investment in "The Little Publication of Common-Sense Investing." He contends that most actively managed funds fail to outperform the retail continuously and that investors may get better outcomes by investing in low-cost index funds that track the general retail. His support for simplicity, diversity, and long-term thinking resonates with readers seeking a simple and productive investment strategy.

8.Edwin Lefèvre's "Reminiscences of a Merchandise Operator"

Despite being a work of fiction, Edwin Lefèvre's "Reminiscences of a Merchandise Operator" provides readers with essential insights into the thoughts and experiences of a merchandise trader. The novel is based on the life of Jesse Livermore, one of history's most famous traders. His eloquent writing and representation of the emotional rollercoaster that traders go through make this publication a must-read for anyone interested in the psychological elements of trading and investing.

9.Warren Buffett's "The Compositions of Warren Buffett"

Warren Buffett, one of the world's most successful investors, imparts his wisdom and investing philosophy in "The Compositions of Warren Buffett." The publication is a compilation of his yearly letters to Berkshire Hathaway merchandise holders. His compelling arguments center on the notions of value investment, economic moats, and the significance of having a long-term view. Readers receive vital insights into this investing legend's thoughts and are motivated to take his slow and disciplined approach to wealth-building.

10.Joel Greenblatt's "The Little Publication That Still Beats the Retail"

In his publication "The Little Publication That Still Beats the Retail," Joel Greenblatt introduces the notion of a "magic formula" for merchandise trading. He pushes for a quantitative strategy that blends value and quality investment ideas. The publication walks readers through a straightforward merchandise selection method that focuses on purchasing inexpensive firms with high earnings and returns on capital. Historical performance data support his convincing thesis and offer readers a methodical merchandise-picking strategy.

Conclusion

To establish a successful and lucrative portfolio, investors must first thoroughly understand the merchandise retail. The top ten merchandise retail publications discussed in this article provide research and accurate insights into various investment techniques, ideologies, and retail dynamics. These publications are educational and convincing, encouraging readers to approach investing with discipline, patience, and a long-term outlook.